Bad Credit Home Loans

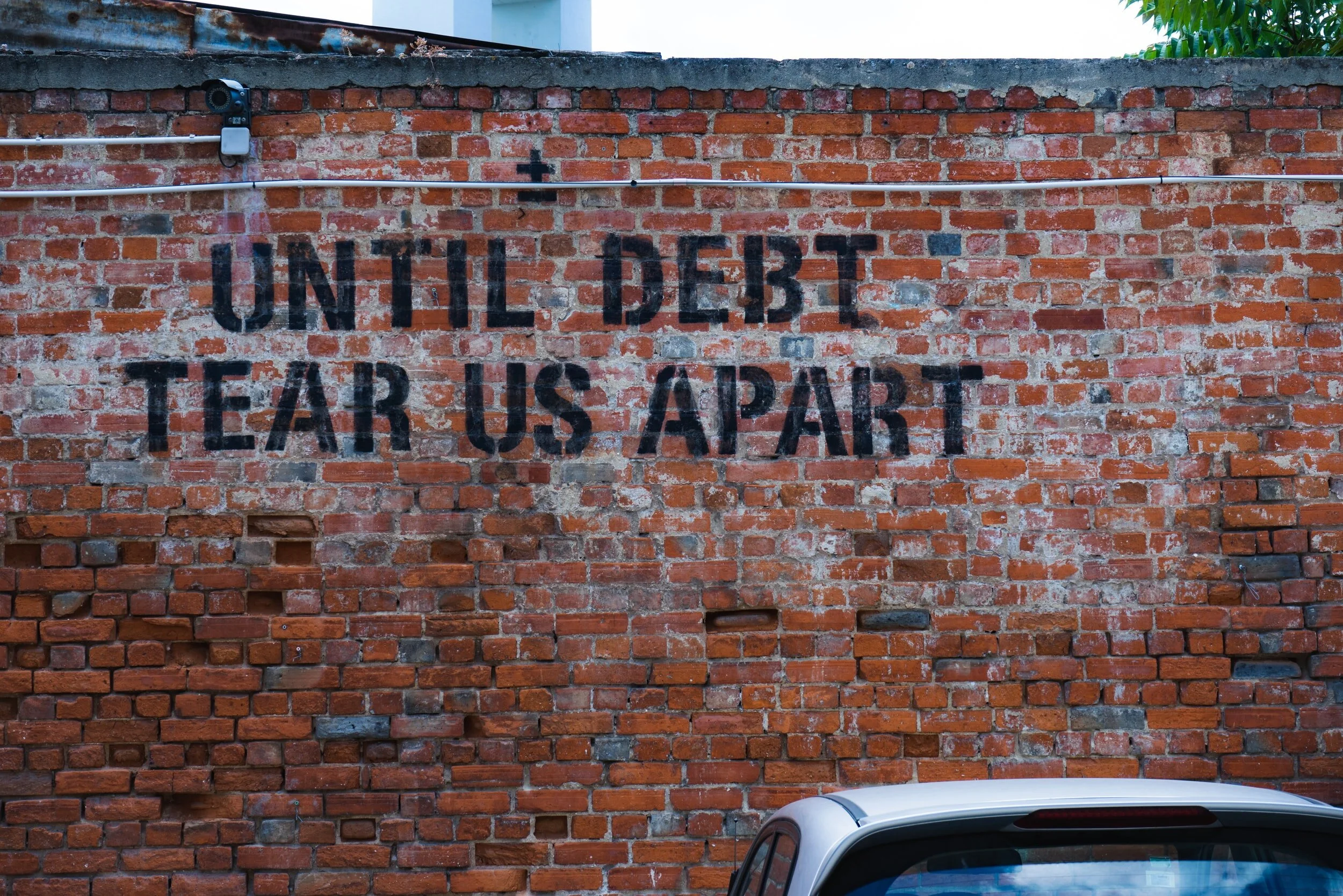

Even with bad credit or past credit issues, we can help you get the home loan refinance or debt consolidation home loan you need. Don’t let bad credit or mortgage arrears stop you!

Bad Credit Home Loans enables you to clean up your current or past credit issues, whether it be credit defaults, court judgements or even current mortgage arrears or missed loan repayments.

We specialise in helping borrowers in your position whether it be a low doc home loan refinance, for self employed borrowers, or simply you have credit issues or the banks have knocked you back for finance.

Benefits Of A Bad Credit Home Loan:

Lower interest rate

Payout high interest personal and business debts into one (Debt consolidation)

Get rid of bad credit defaults, loan arrears, bad debts/ loans and bills.

Free up cash for business or personal use

GET YOUR FREE QUOTE

What is the Process

Lenders seek answers to 3 key questions:

What is the value of the property?

They will undertake a property valuation that is generally performed by a specialist professional valuer. They may need to look through the property. They will also look at the market values of comparable properties in the area. In some cases, you may be charged for this service.

Who are you?

Your identity needs to be verified. This is often referred to as a 100 point check. You may be asked for documents such as a drivers licence, passport, credit card, rate notice or utilities account; or something that shows who you are and where you live. Most lenders will require a credit history from a credit agency.

Can you afford the repayments?

This is usually referred to as 'serviceability'. Lenders need to know that you can afford the loan. You need to be open and honest as you could be breaking the law if you deceive the lender. It is a legal offence for a lender to lend funds to someone who can't afford the repayments, so lenders take this criteria very seriously.

Other Home Loan Types